Operating a business often involves a tumultuous journey with its fair share of highs and lows. While you focus on delivering top-notch products and services to your clients. The last thing you want to worry about is managing your finances. Enter Managed Accounting Services – your secret weapon for maintaining financial stability while you focus on what you do best. Managed Accounting Services, also known as Outsourced Accounting Services or Professional Accounting Services, refer to the practice of outsourcing all or a significant portion of a company’s accounting. And financial management tasks to a specialized service provider or firm. These services are typically offered by certified accountants, financial experts. And accounting firms with expertise in various aspects of financial management.

Managed Accounting Services, often referred to as outsourced accounting services. Provide businesses with a strategic solution to their financial management needs. This approach involves entrusting specialized accounting professionals and firms. To handle tasks like bookkeeping, financial reporting, taxation, payroll management, and more. By outsourcing these critical functions, companies can focus on their core operations and growth. Leaving the complexities of financial management to experts. This not only ensures financial accuracy and compliance but also offers cost-effective and flexible solutionS. That can be tailored to the unique requirements of each business.

What Are Managed Accounting Services?

Let’s start with the basics. Managed Accounting Services, often referred to as MAS, are a comprehensive suite of financial services designed to handle all your accounting needs. These services are usually provided by a team of experts who act as an extension of your in-house finance department. They offer comprehensive services, including bookkeeping and tax preparation, to meet all your financial needs.

Unveiling the Magic of Managed Accounting Services

Managed Accounting Services, often likened to having a financial fairy godmother, play a pivotal role in transforming the way businesses handle their finances. It’s as if a hidden treasure chest of financial wisdom and business magic is unlocked when you delve into the world of managed accounting services. First things first, what exactly are managed accounting services? Well, it’s like having your financial fairy godmother who takes care of all your accounting needs while you focus on making your business dreams come true. Managed accounting services are your personal finance gurus, handling everything from bookkeeping to financial reporting.

Managed Accounting Services are the guardian angels of your financial well-being. These financial experts take the helm of your accounting and financial management, allowing you to direct your energies toward achieving your business dreams. They ensure that your books are in impeccable order, that your taxes are filed accurately, and that you have a clear, real-time view of your financial health. In other words, they take care of the financial nitty-gritty, leaving you free to focus on what you do best: growing your business.

The 360-Degree View of Managed Accounting Services

Bookkeeping Made Breezy: Managing your financial records can be an overwhelming task. MAS experts are here to take this burden off your shoulders. They’ll ensure your books are always up to date, making your life easier during tax season.

Tax Compliance: Tax laws are ever-evolving. With MAS, you’ll have peace of mind, knowing that professionals are staying up-to-date with the latest regulations and ensuring your business stays compliant.

Financial Analysis:It’s not just about crunching numbers; it’s about understanding them. MAS provides insightful financial analysis, helping you make informed decisions for your business.

The Power of Delegation

Delegation is a fundamental management skill that can significantly impact an individual’s or an organization’s effectiveness and productivity. It involves entrusting tasks, responsibilities, and decision-making authority to others, and it is a powerful tool for achieving goals and fostering growth. Here are some key aspects of the power of delegation:

Increased Efficiency: Delegation allows individuals to focus on their core responsibilities and strengths while passing routine or less critical tasks to team members. This specialization increases overall efficiency and productivity.

Time Management: Delegating tasks saves time. When responsibilities are distributed effectively, leaders and team members can allocate their time to higher-priority activities and strategic planning.

The Benefits of Managed Accounting Services

Now that we know what Managed Accounting Services entail let’s delve into the myriad benefits they offer:

Time is Money: Running a business is time-consuming. With MAS handling your finances, you can free up your valuable time to focus on expanding your business and delighting your clients.

Expertise Matters: When you choose MAS, you gain access to a team of skilled accountants who are experts in their field. Say goodbye to sleepless nights worrying about the accuracy of your financial records.

The Swiss Army Knife of Financial Management

Managed accounting services are like the Swiss Army knife of financial management. They offer a range of services, including tax preparation, payroll management, financial analysis, and more. It’s your one-stop solution for all things financial.In the world of financial management, there’s a versatile tool that often earns the moniker The Swiss Army Knife.This metaphorical tool is none other than the modern accounting software or financial management platform. Here’s why it’s likened to the Swiss Army Knife:

Multi-Functionality: Just like a Swiss Army Knife is equipped with various tools for different purposes, financial management software can handle a wide range of financial tasks. It can manage accounting, payroll, invoicing, expense tracking, budgeting, and more, all within a single platform.

Customization: Financial software is versatile, allowing you to tailor it to your specific needs. You can choose and customize features to suit your business’s financial requirements, making it a versatile tool for businesses of all sizes.

Expertise at Your Fingertips

One of the coolest things about managed accounting services is that you’re tapping into a wealth of expertise. These professionals know the ins and outs of the financial world, and they’re always updated on the latest rules and regulations. So, you can rest assured that your financial ship is sailing in smooth waters.In today’s digital age, expertise is readily accessible, right at your fingertips. The internet has transformed how we acquire knowledge and skills. From online courses and tutorials to expert forums and knowledge-sharing platforms, a world of information is just a click away.

This democratization of expertise empowers individuals and businesses to learn, grow, and solve problems with unprecedented ease.Online forums, educational websites, and expert networks connect you with specialists from around the world. This democratization of expertise has empowered individuals and businesses to make more informed decisions, expand their knowledge, and find solutions to a wide range of challenges. As a result, expertise is no longer confined to a select few but has become a valuable resource accessible to anyone with an internet connection.

A Cost-Effective Choice

Now, you might be thinking, All this expertise must come with a hefty price tag. But surprise! Managed accounting services are often a cost-effective choice. You pay for the services you need when you need them, without the hassle of hiring and maintaining an in-house accounting team. When making decisions for your business, cost-effectiveness is often a paramount consideration. Choosing cost-effective solutions can significantly impact your bottom line and overall financial health. Whether it’s in the realm of technology, procurement, or operational strategies, opting for a cost-effective choice is a smart move.

Cost-effective choices don’t necessarily mean compromising on quality. It’s about finding the right balance between affordability and performance. By thoroughly assessing options, comparing pricing, and considering long-term benefits, you can make choices that not only save money in the short term but also contribute to sustainable and profitable growth in the future. From selecting budget-friendly software solutions to optimizing supply chain management, every cost-effective choice adds up to enhance your business’s financial stability and competitiveness.

Staying Compliant and Stress-Free

Managed accounting services ensure that your business stays compliant with tax laws. They keep you stress-free and save you from last-minute tax return nightmares. It’s like having a superhero accountant on speed dial. In the complex and ever-evolving world of regulations and compliance, maintaining adherence to laws and industry standards is a critical priority for businesses. Staying compliant not only ensures that a company operates within legal boundaries but also plays a significant role in reducing stress and minimising potential risks.

Compliance is more than just ticking boxes; it’s about establishing robust processes, monitoring changes in regulations, and proactively adapting to them. By consistently following best practices, employing compliance experts, and leveraging technology solutions, businesses can not only meet legal requirements but also experience the peace of mind that comes with knowing they are operating stress-free in a compliant manner. This not only mitigates potential legal and financial issues but also contributes to a positive reputation and the trust of customers and partners.

Real-Time Financial Insights

In the fast-paced world of finance, having access to real-time financial insights is essential for making informed decisions, managing risks, and staying competitive. Real-time financial insights refer to the immediate, up-to-the-minute data and analysis of an organization’s financial performance, market conditions, and economic trends. These insights provide a clear and current picture of the financial health of a business and enable timely responses to changing circumstances. Here are some important factors to take into account:

Immediate Decision-Making: Real-time financial insights allow businesses to make decisions quickly and accurately. Whether it’s adjusting investment strategies, altering pricing models, or reallocating resources, having access to real-time data is invaluable.

Risk Management: Timely access to financial data helps in identifying and mitigating risks as they arise. This can include detecting fraudulent transactions, market volatility, or any unusual financial anomalies.

Performance Monitoring: Businesses can track their financial performance in real-time, comparing it against key performance indicators and financial goals. This enables rapid adjustments to meet targets and improve overall performance.

Scaling Your Business for Managed Accounting Services

Scaling a business refers to the strategic process of expanding and growing the operations and capabilities of a company. It involves increasing revenue, market presence, and the overall capacity to serve a larger customer base. Successful scaling requires careful planning and execution. Here are some key strategies and considerations for scaling your business:

Clear Vision and Strategy: Before scaling, define a clear vision for your business. Understand your long-term goals, target markets, and the value you provide. Develop a comprehensive strategy that outlines how you will achieve your growth objectives.

Market Research: Thoroughly research your target market and audience. Understand their needs, preferences, and pain points. Tailor your products or services to meet these requirements effectively.

Operational Efficiency: Streamline your operations to increase efficiency. Look for opportunities to reduce costs, improve processes, and enhance productivity. Automation and technology can often play a significant role in achieving operational excellence.

The Human Touch

In an increasingly digital and automated world, the human touch remains irreplaceable. It represents the essential element of empathy, personal connection, and emotional understanding. Whether in customer service, healthcare, or interpersonal relationships, the human touch adds a level of warmth and authenticity that technology alone cannot provide. It’s a reminder that, at our core, we are social beings who thrive on real, human interactions and genuine care for one another.

The human touch extends beyond simple transactions; it encompasses the ability to listen, empathize, and respond with kindness. In healthcare, it can make a patient feel valued and comforted. In business, it can turn a dissatisfied customer into a loyal advocate. It’s a reminder that, in the midst of our fast-paced, technology-driven world, the most profound and lasting impact often comes from the simple act of connecting on a human level, showing understanding, and extending a hand of genuine support.

Unravelling the Technology for Managed Accounting Services

Okay, let’s get a bit techy here. Managed accounting services often use cutting-edge accounting software. This technology streamlines processes, reduces errors, and boosts efficiency, making your financial management a breeze. In our rapidly evolving technological landscape, understanding and adapting to new innovations can be a complex and ongoing journey. “Unravelling the Technology” signifies the process of breaking down and comprehending the intricacies of modern tools, systems, and digital advancements.

It is a quest for knowledge, an exploration of the digital frontieR. And a recognition of the transformative power that technology wields in reshaping our lives, businesses, and the world as a whole. As we unravel the technology, we uncover new possibilities, harness its potential. And navigate the challenges that come with this ever-changing landscape. It is a reminder that, while technology can be complex. It is also a source of limitless opportunities for innovation, connection, and progress.

The Dream Team

Think of managed accounting services as your dream team. They’re the financial sidekicks you need on your entrepreneurial journey. With their help, you can turn your business dreams into reality. So, there you have it, the fascinating world of managed accounting services. They’re your partners in financial success, your guardians against financial chaos, and your ticket to a stress-free business life. If you’ve ever thought about how to make your financial management more efficient and effective. Managed accounting services might just be your golden ticket.

As we wrap up our adventure, remember that your business deserves the best. So why not explore the world of managed accounting services and let the financial magic unfold? It’s your journey, and with the right companions, you can conquer any financial mountain that stands in your way.

Conclusion

In today’s ever-evolving world, from managing businesses to harnessing the power of technology. And cherishing the human touch, the common thread that ties it all together is adaptability. Success lies in our ability to adapt to change, to learn from the past. And to seize the opportunities of the present. Whether it’s through scaling a business, embracing real-time financial insights. Or understanding the value of delegation, the core principles of vision, strategy, and adaptability remain essential.

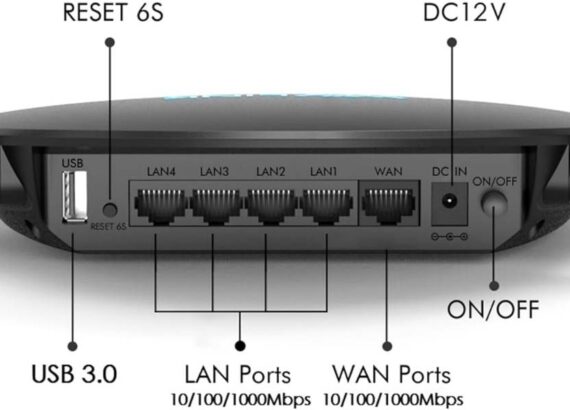

When it comes to managing the financial aspects of your business efficiently. Opting for managed accounting services can be a game-changer. These services offer real-time financial insights, helping you scale your business effectively by providing accurate and up-to-date financial data. Similarly, just as a well-managed financial system is crucial for the smooth operation of a business, having the best DD-WRT router in your office network is equally important. DD-WRT routers provide advanced features and security, allowing for seamless data transmission, especially in the context of real-time financial data.